Sell your Home

Trust The Selling of Your House To The Area’s Top Broker !

Our Team Will Create A Selling Strategy That Works For You!

At Cari4Homes, we know that selling your house is a big step! You might feel overwhelmed or burdened by everything involved in selling your house.

You might be wondering what your house is worth or if it’s really the right time to sell. Maybe you lead a busy life and don’t want to deal with listing your property on top of everything else you have to deal with.

This is where we can help. We take a personalized approach to every sale. We will create a custom plan of action that meets YOUR needs. We will discuss your priorities and timeframe, helping you to sell with less hassle while putting more cash in your pocket.

Questions About This Property

Questions About This Property

How We’re Different From The Competition

How We’re Different From The Competition

Any Real Estate Broker can list your property on the MLS, but a truly successful selling experience takes much more work. You need to have a plan of action to get your house in front of the right buyers at the right times. You need to finely craft and deliver the right marketing message and do whatever it takes to set your house apart from the others on the market. At Cari4Homes, we have the experience (over 1,600 area properties sold) and the market knowledge to help you sell your house fast and for a great price.

We go above and beyond to sell your area house fast and charge a reasonable and straightforward commission.

Our Process Is Simple

We’ll research your house and provide a FREE Home Value Report

We’ll recommend a target “sale price” and describe exactly how we arrived at it. We are an open book, ask us anything at any time!

We will offer a flexible listing agreement, with a fair commission.

We handle all the details to get your house sold fast! Leave everything to us!

Let Our Local Selling Experience Save You Time and Reduce Your Stress !

If you decide to list with a cut-rate broker or sell on your own, the property might sit on the market for a while. When it sits too long, it becomes stale, losing its appeal to potential buyers. The longer you continue to own it, the more money it is costing you. We work with sellers all the time who’ve tried to sell with a less experienced broker, only to find themselves stuck with the house when the listing expires. These sellers inevitably call us to help with their home selling needs.

Between our experience, unique marketing and winning sales strategies, we will help you sell easily, reducing the average days on market! We believe in providing amazing service, so you can move on with your life!

Home Values Are Always Changing: What’s Your Home Worth Today?

Do you want to learn more about Cari ? Click here!

Or call the office directly!

Learn more about property values!

Fill out the short form below to get a free and accurate Home Value Report for your house. Utilize up-to-date data and home value trends when selling a house!

SEARCH HOMES

THE FED’S BALANCING ACT

THE FED’S BALANCING ACT: HOUSING SLOWDOWN, INFLATION FEARS, AND RIPPLE EFFECTS IN REAL ESTATE

INTRODUCTION: WHY THIS MATTERS

The housing market is once again at the center of the economic conversation. According to Reuters (Aug 20, 2025) and The Wall Street Journal, the Federal Reserve is walking a tightrope between lowering interest rates to help housing or holding them steady to avoid fueling inflation.

This is not an abstract debate. Already this week, ripple effects have shaken major players tied to housing:

Home Depot reported sales down 4% as homeowners cut back on renovations.

James Hardie Industries saw its stock plunge nearly 30%—its sharpest decline in 50 years—after warning that demand for repairs and new construction in North America is weakening.

So what does this mean for the housing market—and for everyday buyers, sellers, and investors?

THE FED’S ROLE IN HOUSING

The Federal Reserve sets short-term interest rates, which directly influence mortgage rates. When the Fed raises rates, borrowing becomes more expensive. When it cuts rates, borrowing becomes cheaper.

Lower rates = cheaper mortgages, more buyers entering the market, more refinancing, and often more activity in homebuilding.

Higher rates = more expensive mortgages, fewer buyers, slower sales, and builders pulling back.

But the Fed’s job isn’t just about housing—it’s about balancing the entire U.S. economy. And right now, that means juggling two competing forces:

Housing slowdown. Builder confidence has fallen, permits are down, and affordability remains at crisis levels.

AI boom. Investment dollars are flooding into artificial intelligence and tech, creating fears that if rates fall too quickly, the economy could overheat.

This balancing act is what’s keeping rates stuck in the “mid-sixes,” frustrating buyers, sellers, and builders alike.

RIPPLE EFFECT #1: HOME DEPOT

On August 19, 2025, Home Depot announced its summer sales were down 4%. That’s a big deal because Home Depot isn’t just a hardware store—it’s a window into the renovation economy.

When homeowners feel confident, they remodel kitchens, redo bathrooms, add decks, and invest in upgrades. When they’re worried—or when mortgage rates are eating up their budgets—they hold back.

That slowdown shows up in Home Depot’s numbers, and it’s a direct reflection of today’s affordability crisis.

RIPPLE EFFECT #2: JAMES HARDIE INDUSTRIES

Just one day later, Yahoo Finance reported (Aug 20, 2025) that James Hardie Industries—the world’s largest producer of fiber cement siding and a major supplier of building materials—warned about weakening U.S. demand for both repairs and new construction.

The result? Its stock crashed nearly 30%, the sharpest decline since 1973.

This is a red flag because James Hardie supplies builders across North America. When a company like this says demand is slipping, it means builders are either delaying projects or scaling back expectations.

HOW THESE STORIES CONNECT

These two stories—Home Depot’s sales dip and James Hardie’s stock plunge—aren’t random. They’re part of the same chain reaction:

High mortgage rates → buyers hesitate → sellers hold back → builders slow down.

Slower building and fewer renovations → less demand at Home Depot and Lowe’s → weaker orders for James Hardie and other suppliers.

Investor reaction → stocks drop → confidence in housing weakens further.

And looming over all of this is the Fed’s decision. Cut rates, and housing could see relief—but inflation may reignite. Hold rates steady, and housing pain deepens.

WHAT THIS MEANS FOR BUYERS

If you’re a buyer, today’s housing market feels stuck. Rates are still in the mid-sixes, and prices remain high. You might be asking: Is it better to wait, or jump in now?

Here’s what matters:

Inventory is slowly rising, but not enough to tip the market fully into a buyer’s favor.

Builders are offering the highest incentives in five years, including rate buydowns, upgraded features, and even price cuts.

If rates drop, competition could surge. Waiting might mean you face more bidding wars later.

WHAT THIS MEANS FOR SELLERS

For sellers, the challenge is standing out in a cautious market. Buyers want move-in ready homes because they can’t afford big renovations on top of high mortgage payments.

That means:

Homes that are upgraded and priced right still sell quickly.

Homes needing work may linger, or sell only with concessions.

Even “perfect” homes sometimes require seller incentives to move.

WHAT THIS MEANS FOR INVESTORS

For investors, the signals are mixed. On one hand, retail and supplier stocks tied to housing (like Home Depot and James Hardie) are feeling the pain. On the other, demand for rental housing remains strong, and markets outside high-cost cities are still seeing activity.

Investors should watch the Fed closely: a shift in rates could create new opportunities—but also new risks if inflation surges again.

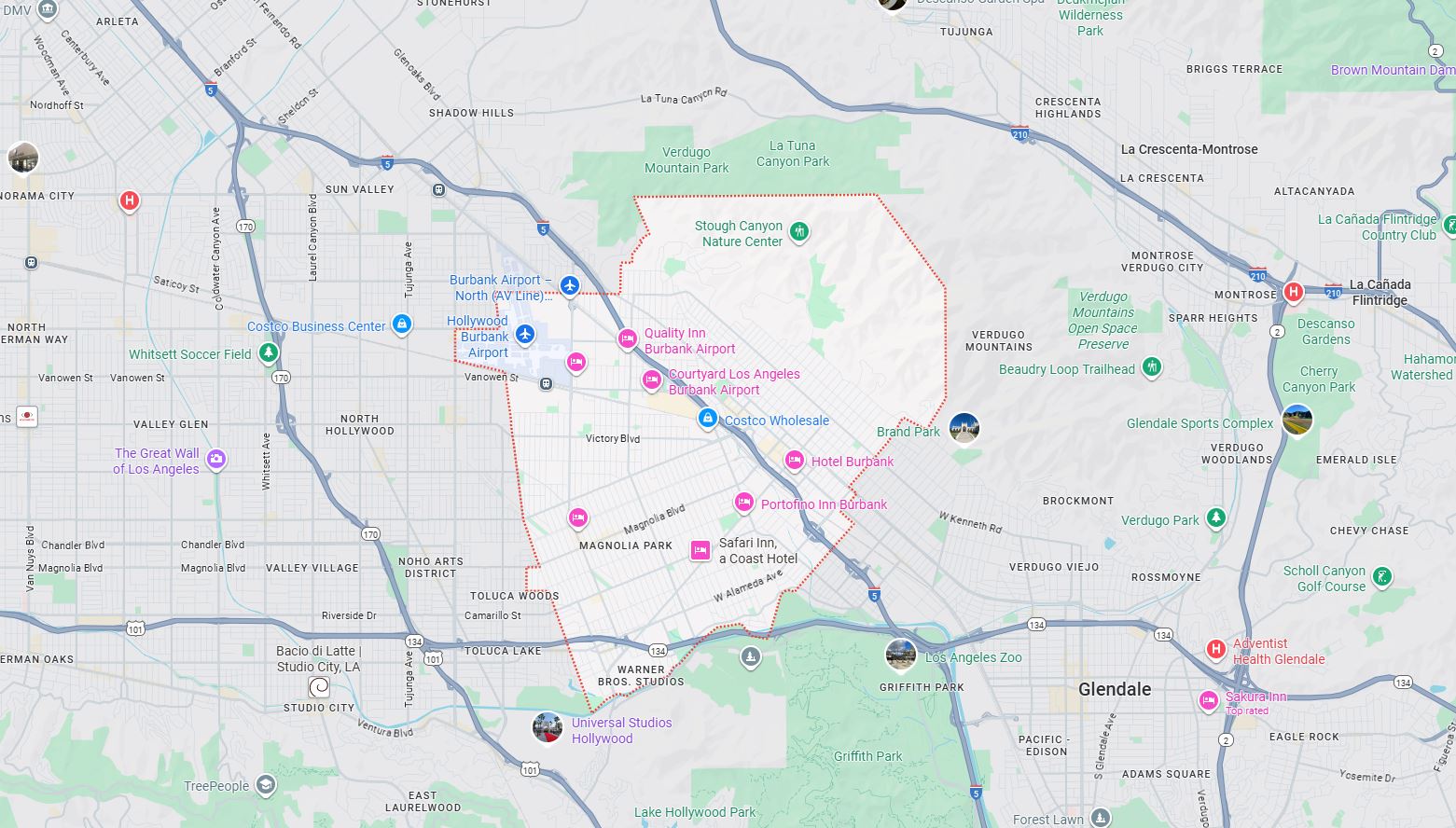

LOCAL ANGLE: LOS ANGELES & BURBANK

Here in the Los Angeles area, the ripple effects are visible:

New apartment buildings are popping up, but rents are still sky-high, leaving affordability unresolved.

Many sellers are hesitant to list, worried they won’t get their price.

Buyers are frustrated—either priced out or facing homes that need upgrades they can’t afford.

The Fed’s decisions in the coming months will directly impact whether L.A. stays frozen—or starts moving again.

CONCLUSION: THE BIG QUESTION

The Fed is at a crossroads. Lower rates could spark housing activity but risk reigniting inflation. Higher rates keep inflation in check but deepen the housing slowdown.

Meanwhile, the ripple effects are undeniable: from Home Depot to James Hardie, to local builders and everyday homeowners.

So what do you think?

👉 Should the Fed cut rates to give housing a boost?

👉 Or keep rates high to protect the broader economy?

Referenced Articles & Sources

Fed’s Dilemma: Housing vs AI

Source: Reuters

Headline: "Fed’s dilemma between AI and housing"

Summary: The Fed is torn between supporting the cooling housing market and not overheating the economy amid surging AI investment.

Home Depot Sales Slow

Source: Reuters

Headline: Home Depot sales down 4% (as part of housing slowdown coverage)

Summary: Indicates weakening homeowner renovation activity.

Yahoo Finance+11Barron's+11Axios+11 (same broad report)

James Hardie Stock Plunges

Source: Yahoo Finance

Headline: "James Hardie shares sink 30%"

Summary: A major building materials company sees its stock fall sharply amid weakening US housing demand.

Housing Starts in July

Source: Reuters

Headline: "U.S. housing starts tick higher in July, led by apartment construction"

Summary: Indicates multifamily construction is up, but overall permits are down.

Stay Connected!

Thank you for reading! Follow me on social media and YouTube for more tips, updates, and behind-the-scenes moments. Let’s stay in touch!

📍 Instagram: https://www.instagram.com/cari4homes/

📍 Facebook: https://www.facebook.com/cari4homes/

📍 LinkedIn: https://www.linkedin.com/in/cari4homes/

📍 YouTube: www.youtube.com/@SanFernandoValleyHomes

Subscribe, comment, or send me a message—I’d love to hear from you!

Or give us a call at 818 415 3657 to chat with us over the phone

10153 Riverside Drive, Toluca Lake, CA 91602

Copyright © 2023 Cari4Homes. All Rights Reserved. Privacy Policy